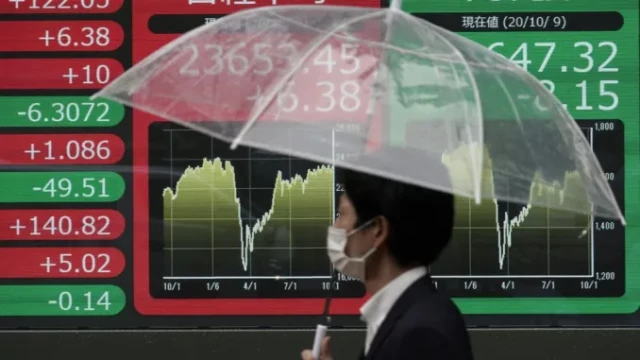

Stock investors were cautious about extending recent gains on Monday, with discussion centered on the size of U.S. interest rate cuts expected this week, but sentiment was dampened by concerns about the Chinese economy.

Ahead of Wednesday's Federal Reserve decision and the Bank of Japan's policy meeting two days later, the yen fell below 140 yen to the dollar for the first time since mid-2023, while gold prices hit a new record high.

Data showing U.S. inflation slowed more than expected last month to the lowest since February 2021 has sparked renewed speculation that Fed officials will announce a big 50 basis points (bp) rate cut and extend easing into the year.

Bets are rising for such a move, but some analysts have warned it could signal policymakers are worried about the economy, especially after two reports showing a weakening labor market.

Bankers have indicated they are open to discussing a wider cut, though they haven't played their cards yet, while former New York Fed president Bill Dudley said he believes "there is a strong case for 50."

"The Fed, like other central banks, is now focused on economic growth, not inflation risk," said Michael Krautzberger of Allianz GI. "

There are growing concerns that monetary policy is behind the curve and that interest rate cuts may come too late to avert a recession or a sharp slowdown in growth."

"Therefore, in our view, we cannot rule out the risk of a significant rate cut at the next meeting later this year, especially if labor market activity deteriorates more quickly than currently expected and inflation continues to move toward our target," he said.

All three major Wall Street indexes rose on Friday, with the Dow and S&P 500 within striking distance of all-time highs.

However, Asian markets were volatile, with Hong Kong, Sydney, Taipei, Mumbai, Bangkok and Manila slightly higher, while Singapore and Wellington fell, and London, Paris and Frankfurt also fell.

Trading in Asia was muted due to public holidays in Tokyo, Shanghai, Jakarta and Seoul. In currency markets, the yen briefly hit 139.58 to the dollar, its highest since July last year, while gold hit a new record of 2,589.70.

Traders are closely monitoring developments in China as further weak data on credit, retail sales, industrial production and property prices raised concerns about the world's second-largest economy.

National Australia's Ray Attrill said the figures "intensify overall concerns that the policy measures announced in recent weeks and months, following weak second-quarter results, have so far not had a measurable impact on spurring economic growth in the third quarter."

He added that investors are keeping an eye on the government's upcoming Politburo meeting (date not yet known).

Following a string of disappointing figures recently, the central bank outlined its plans to support the economy, saying it will "make maintaining price stability and promoting a gradual recovery in prices a key aspect of monetary policy, and better target adequate financing needs for consumption."

The Bank of Japan is expected to follow suit on Friday following the Fed's decision, with most analysts expecting it to keep rates unchanged after its surprise rate hike in late July caused market turmoil.

IG analyst Tony Sycamore said "the successive hikes are likely to be seen as too aggressive, especially given criticism that the BOJ's hawkish stance contributed to the turmoil in global markets in early August."

"But stronger-than-expected inflation and wage growth in Japan last month has given the Bank of Japan confidence that the wage and price cycle is capable of sustaining inflation above 2 percent, paving the way for further monetary tightening."

– Key figures around 0810 GMT –

Hong Kong – Hang Seng Index: UP 0.3 per cent at 17,422.12 (close)

London – FTSE 100: FLAT at 8,271.09

Tokyo – Nikkei 225: Closed for a holiday

Shanghai – Composite: Closed for a holiday

Dollar/yen: DOWN at 139.79 yen from 140.76 yen on Friday

Euro/dollar: UP at $1.1117 from $1.1079

Pound/dollar: UP at $1.3174 from $1.3125

Euro/pound: DOWN at 84.39 pence from 84.40 pence

West Texas Intermediate: UP 1.0 per cent at $69.35 per barrel

Brent North Sea Crude: UP 0.8 per cent at $72.18 per barrel

New York – Dow: UP 0.7 per cent at 41,393.78 (close)

AFP